Understanding Zoning Laws and How They Affect Home Sales

When it comes to buying or selling a home, one crucial factor that can significantly impact the process is zoning laws. Zoning laws dictate how land can be used in different areas, influencing everything from property values to the types of buildings that can be constructed. Understanding these laws is essential for both buyers and sellers to navigate the real estate market effectively. Here’s what you need to know about zoning laws and how they affect home sales.

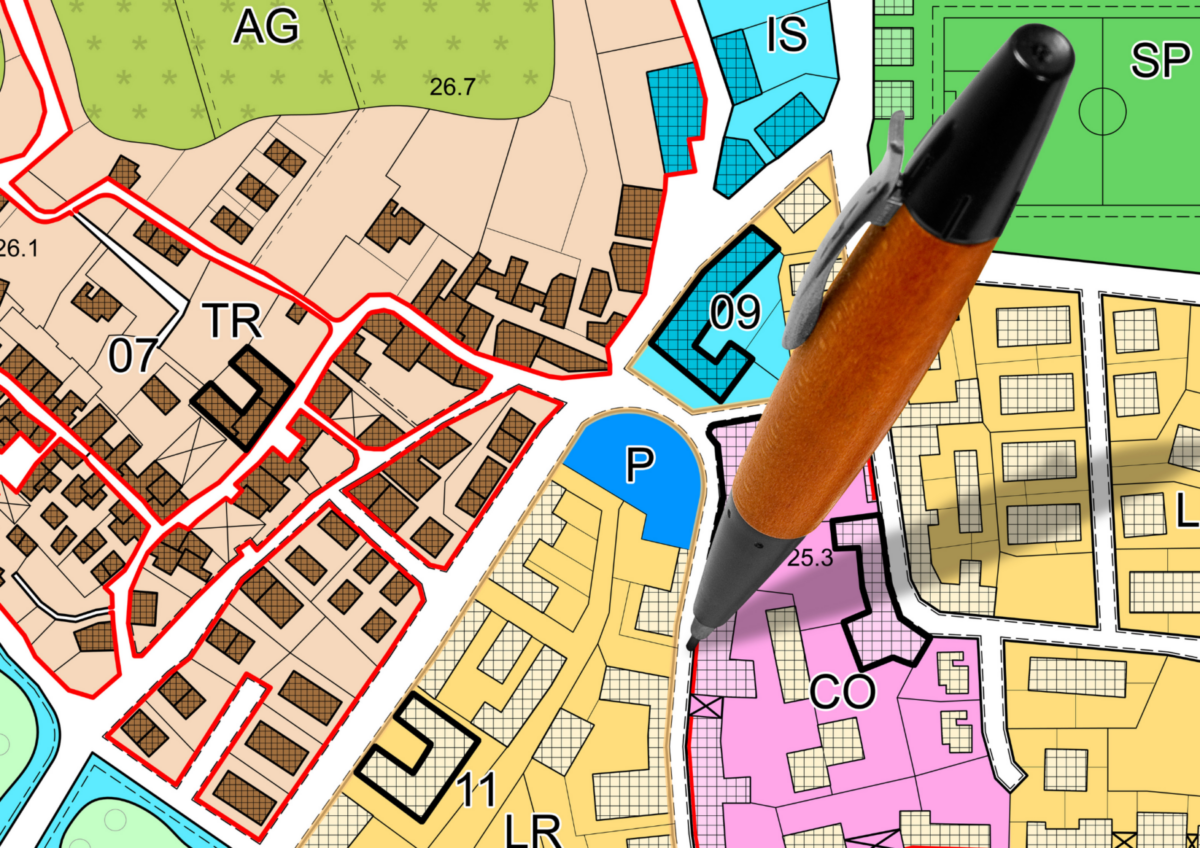

What Are Zoning Laws?

Zoning laws are regulations established by local governments to control land use within their jurisdictions. These laws divide a city or town into different zones, each designated for specific uses such as residential, commercial, industrial, or agricultural. Zoning laws aim to promote orderly development, reduce conflicts between land uses, and protect public health and safety. Learn more about Zoning Laws here.

Types of Zoning

Residential Zoning

Residential zoning is for areas designated for housing. These zones can be further categorized into single-family, multi-family, and mixed-use residential areas. Residential zoning laws can dictate the types of homes that can be built, minimum lot sizes, building heights, and setback requirements.

Commercial Zoning

Commercial zoning applies to areas designated for business activities such as retail stores, offices, and restaurants. These zones have specific regulations regarding building types, parking requirements, signage, and the types of businesses that can operate.

Industrial Zoning

Industrial zoning is for areas intended for manufacturing, warehousing, and other industrial activities. These zones typically have regulations to minimize environmental impacts, such as noise and pollution controls.

Agricultural Zoning

Agricultural zoning is for areas designated for farming and related activities. These zones often have regulations to protect farmland from being converted to non-agricultural uses.

How Zoning Laws Affect Home Sales

Property Values

Zoning laws can have a significant impact on property values. Properties located in desirable residential zones, especially those near good schools, parks, and other amenities, tend to have higher values. Conversely, properties in zones with less desirable uses, such as industrial areas, may have lower values. Understanding the zoning of a property can help sellers price their homes appropriately and buyers make informed decisions.

Development Potential

Zoning laws also affect the development potential of a property. For example, a property in a residential zone might have restrictions on the number of units that can be built, while a property in a mixed-use zone might allow for both residential and commercial development. Buyers interested in renovating or expanding a home should be aware of these restrictions to avoid potential legal issues.

Use Restrictions

Use restrictions dictated by zoning laws can impact how a property can be utilized. For instance, a homeowner in a residential zone might be prohibited from operating a business out of their home. Similarly, certain types of commercial activities might be restricted in specific zones. These restrictions can affect the marketability of a property and its appeal to potential buyers.

Legal Compliance

Compliance with zoning laws is crucial for both buyers and sellers. Sellers must ensure that any renovations or additions to their property comply with local zoning regulations. Non-compliance can lead to fines, legal disputes, and complications during the sale process. Buyers, on the other hand, should verify that the property they are interested in complies with zoning laws and that their intended use of the property is permitted.

Zoning Changes

Zoning laws are not static and can change over time. Local governments periodically review and update zoning regulations to reflect changes in community needs and development goals. These changes can affect property values and development potential. For example, if a residential area is rezoned for commercial use, property values might increase due to the potential for new business opportunities. Conversely, if an area is downzoned to limit development, property values might decrease.

Tips for Navigating Zoning Laws

Research Local Zoning Regulations

Before buying or selling a property, research the local zoning regulations to understand how they might affect the transaction. Local government websites and planning departments are good resources for this information.

Consult with Professionals

Navigating zoning laws can be complex and overwhelming, which is why consulting with professionals is so crucial. Realtors, in particular, play an essential role in this process. A knowledgeable realtor can provide invaluable guidance on how zoning laws impact home sales in your area. They are well-versed in local regulations and can help you understand the nuances that might affect your property’s value and marketability.

Real estate agents have access to resources and networks that the average homeowner might not. They can quickly obtain detailed zoning information, assess how it impacts your property, and offer strategic advice. For sellers, a realtor can help highlight the advantages of your property’s zoning in marketing materials, making it more attractive to potential buyers. For buyers, a realtor can ensure that your desired use of a property is feasible under current zoning laws, saving you from potential legal headaches down the line.

Additionally, realtors often have strong relationships with other professionals such as real estate attorneys and local government officials. These connections can be invaluable if you encounter any zoning issues that require expert resolution. In short, partnering with a realtor can provide peace of mind and a smoother, more informed real estate transaction.

Stay Informed About Zoning Changes

Keep an eye on local government meetings and public notices to stay informed about potential zoning changes that might affect your property. Being proactive can help you anticipate and respond to changes that could impact your home sale.

Conclusion

Understanding zoning laws is essential for successful home sales. By being aware of how these regulations impact property values, development potential, and legal compliance, you can make informed decisions and navigate the real estate market with confidence. Whether you’re buying or selling, staying informed about zoning laws will help you achieve your real estate goals.